The average Chatham-Kent homeowner is facing property tax increases of nearly $1,200 over the next four years.

That is the starting point municipal administration has handed Chatham-Kent council.

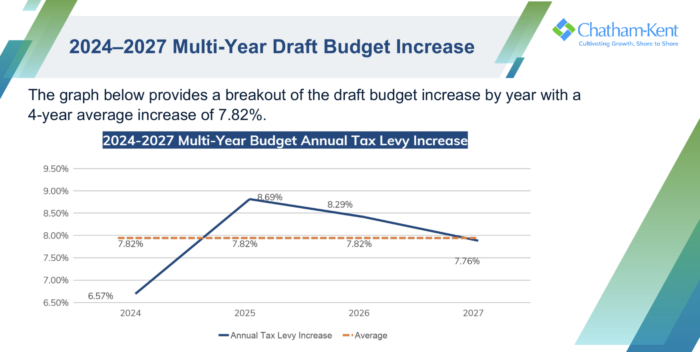

This will be the first dive by council and administration into multi-year budgeting, and from 2024-27, early projections – before council potentially uses its trimming scissors – sees an average increase of 7.82 per cent.

Next year’s proposed increase is the most palatable, at 6.57 per cent. For 2025, the hike spikes at 8.69 per cent, falling to 8.29 per cent in 2026 and then 7.76 per cent in 2027.

Municipal administration, as well as Mayor Darrin Canniff and budget committee chair Brock McGregor sat down with local media Nov. 15 prior to that night’s initial budget unveiling session with council to go into details behind the multi-year planning, as well as the pressures facing C-K finances.

For 2024, Gord Quinton, chief financial officer for the municipality, said inflationary pressures account for four per cent of the 6.57 per cent proposed increase. Infrastructure funding adds 1.5 per cent, policing will add an estimated 0.8 per cent, while other operational needs account for 0.27 per cent.

McGregor said the big factor council and administration face is obviously the cost of inflation, and is something all municipalities in the province are feeling.

Infrastructure lifecycle funding has been underfunded essentially since amalgamation. McGregor said C-K is only funding about half the needed infrastructure maintenance work at this time.

Canniff said we’re not alone.

“This is what every municipality is looking at. We collectively have been lobbying heavily to the (Ontario) government,” he said. “Everybody is saying, ‘We need infrastructure help.’”

Officials lamented the funding system for certain services in Ontario, with what they said was an unfair burden on property taxes. Quinton again pointed to social services as a big concern.

Social service costs in other provinces are not usually on the property tax base. That’s not the case in Ontario.

“There is the concept that the property tax system in Ontario is broken. and needs to be looked at. Things that are happening in society out there, in Ontario, are being forced on the property owners only to pay for,” he said.

Canniff said paying for the homeless shelter should not fall solely on the backs of property owners.

“The homeless shelter costs us $3 million a year and that’s not budgeted. It’s not in our mandate, last time we checked, to pay for affordable housing on the property tax dollar, but that’s what’s happening,” he said, adding it cannot be ignored. “We have to address it. Homelessness exists and it is going to get worse before it gets better.”

Community consultations will take place online on Nov. 22 at noon and Nov. 23 at 7 p.m. on Facebook.

Budget deliberations begin Nov. 28 at 6 p.m. in council chambers and can also be viewed online via Facebook and YouTube.

They could save by forgetting the two pad arena, staying in the current location and not moving to old sears building, sell the Capital Theater which never makes money and probably never will, return to the size of council as they are too many from Chatham as they are the ones who vote what most taxpayers do not approve of, also the Bradley center is not a viable money maker, stop with all the building on good farm land and start purchasing ground which is not as good for agricultural use, save money with building all these sports complexes and star replacing infrastructure for all the homes they are building over Chatham Kent’