By Jenna Cocullo, Local Journalism Initiative

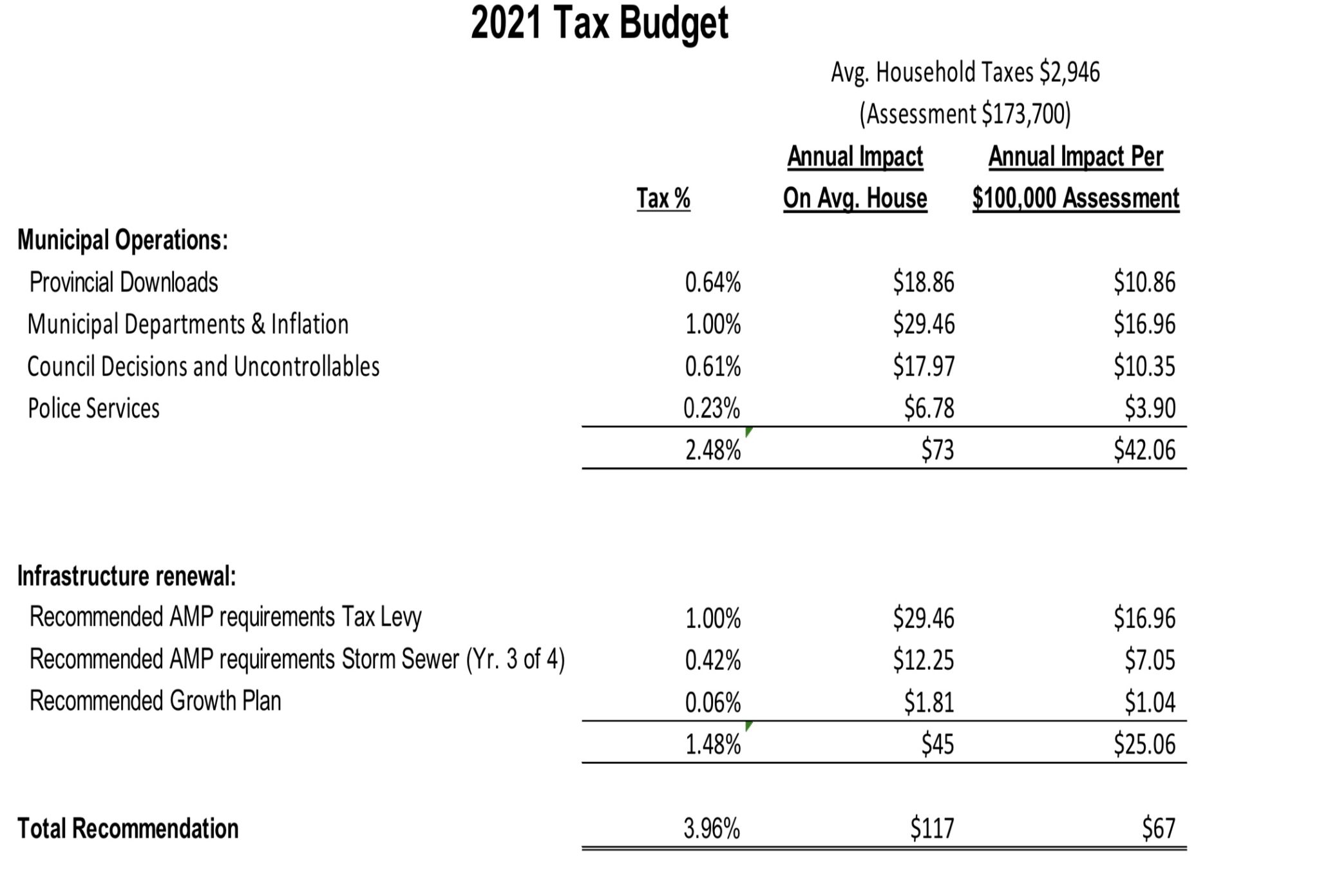

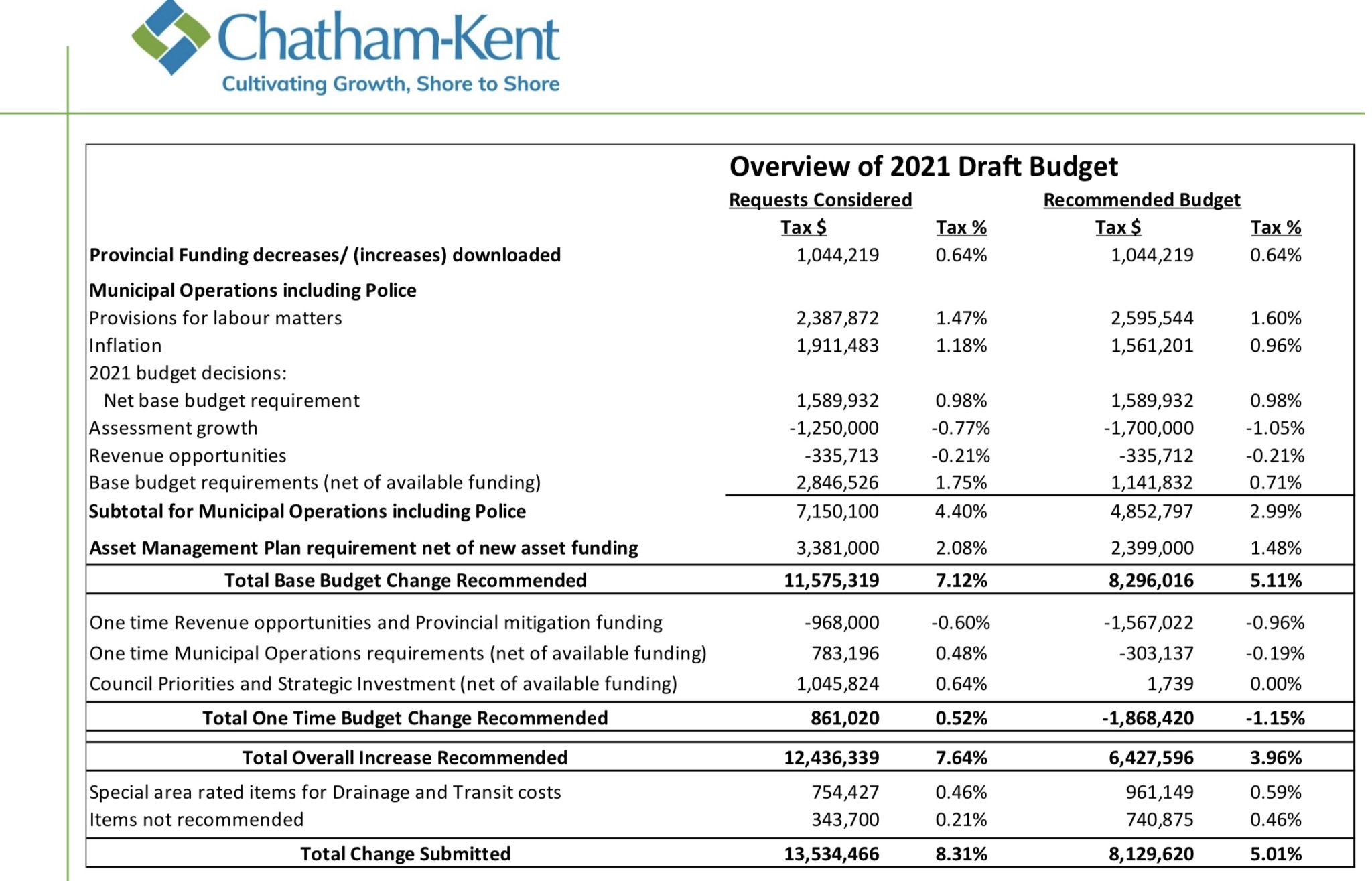

Chatham-Kent taxpayers may be looking at a 3.96 per cent tax increase this year as municipal staff and council begin to discuss the 2021 budget.

The impact on the average house will amount to $117 per year.

On Wednesday, at 6 p.m. the 2021 budget was officially presented to the public. Administration and council will be discussing issues and recommendations throughout the night and the meeting will be broadcast and live streamed by YourTV.

In August, council voted on a motion to achieve a 2021 budget target of a zero per cent increase however, according to a report brought back in December, that was not possible without scaling back services provided to residents.

“Since the August meeting there have been several decisions counter to a zero per cent target with no decreases in service levels desired by council,” the report stated.

The theme of this year’s budget is “investing in our future” which largely focuses on infrastructure.

“Chatham-Kent has an infrastructure deficit and we’ve committed to narrowing that gap year over year. That’s part of where you see some of that increase in investment is around; increasing infrastructure spending, looking at shoreline mitigation and keep working towards some of those goals,” said Chatham Coun. Brock McGregor, who is serving as chair of the budget committee.

While those have been long time goals of the municipality, Chatham-Kent is also focusing on newer investments such as affordable housing, he added.

Similar municipalities in Ontario are raising taxes in between three to eight per cent with few exceptions, according to municipal reports.

The new projects/services asked for by council, increased levels for storm sewers, and general inflation on capital areas all amounted to a 2.53 per cent increase in the budget.

A 0.30 per cent increase was also added to the 2021 budget to maintain the level of existing services after council voted not to change service levels. The municipality had to add on an additional 0.7 per cent to take on extra costs following cuts by the provincial government to housing, child care, and conservation authority funding.

An extra 0.43 per cent tax increase was added to mitigate COVID-19 impacts, although it is anticipated that the provincial government will step in to aid municipalities again this year.

Chatham-Kent’s chief administrative officer, Don Shropshire said there is no telling how COVID will affect municipal finances in 2021. Even though two vaccines have already been approved by Health Canada, it can take months to immunize the majority of the population.

“We believe that the municipality’s in good financial shape, we’ve got a fair bit of resiliency on the budget,” he said. “We’re going to have to be continuing to mitigate some of the costs and trying to find … different ways to treat the lost revenue.”

The COVID-19 pandemic caused the municipality to project approximately a $5 million deficit with lost revenue from the Casino, reduced property taxes for suffering businesses, and increased costs for personal protective equipment (PPE).

Reduced service levels saved $2 million, and in the fall the provincial government stepped in to bail municipalities out because legally they cannot run deficits.

The provincial aid was only to assist municipalities with COVID-19 related costs and as a result Chatham-Kent found themselves with a $1 million surplus from the funding which will be rolled over to this year’s budget.

“But if we expect the same sort of level of impact, our expenses and reductions in revenue might exceed $1 million in which case we’d expect, like other local municipalities, to go back to the province to see if additional support was available,” Shropshire said.

The budget is only a first draft and it’s now in the hands of council to deliberate where to make cuts. No motions will be entertained on Wednesday as it is just an initial presentation.

READ MORE: How to participate in the 2021 budget deliberations