By Pam Wright

Local Journalism Initiative Reporter

When it comes to housing starts, Ontario’s Associate Minister of Housing says Chatham-Kent is setting a fine example.

“Chatham-Kent and all other municipalities that have met or exceeded their housing targets should be proud of the work they have done to get shovels in the ground faster,” Rob Flack told a gathering at a new house on Ironwood Trail in Chatham.

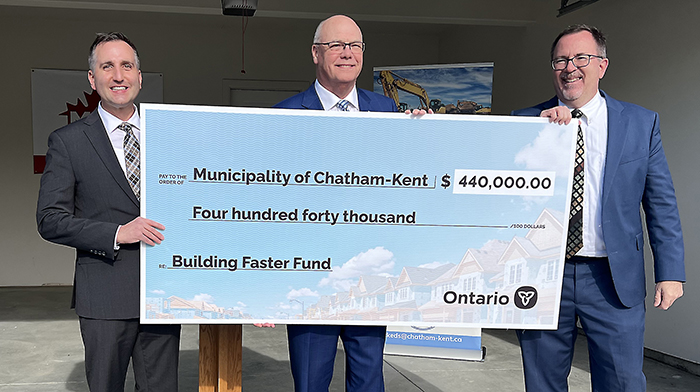

As part of Ontario’s Building Faster Fund to support the province’s goal of building 1.5 million new homes by 2031, Flack came bearing a $440,000 cheque to reward C-K for meeting – and exceeding – its target.

The municipality has done so in spades. In 2023, local builders smashed the province’s designated target of 81 homes by creating 522 new housing starts, exceeding C-K’s goal by 544 per cent.

“Chatham-Kent will be front and centre of everything I say,” Flack quipped to reporters, noting C-K was the first stop he made outside the GTA to hand out Building Faster Fund cash.

C-K Mayor Darrin Canniff said Chatham-Kent has been setting records for a few years now and 2023 was no exception.

“The beauty is that people want to be here, and housing is so critical,” the mayor said. “Our builders – everyone stepped up to make this happen. It’s huge because people are recognizing Chatham-Kent and the funds we are going to be receiving from the province will be reinvested to creating more demand for homes.”

It’s not yet determined how C-K will use its windfall, but Canniff said it will be spent to incentivize people to buy homes.

The mayor noted that the area’s major utilities are working together to create needed infrastructure.

“We’re fortunate we have utilities for the next few years but we need to be thinking ahead to make sure that we have those utilities in place when people want to build,” Canniff said.

By exceeding its goals, Chatham-Kent unlocked an additional $146,667 in funding.

Chatham-Kent-Leamington MPP Trevor Jones thanked his colleague for bringing the cheque and praised Chatham-Kent for “hitting it out of the park.”

According to Flack, Ontario housing starts have been the highest in the last three years since the 1980s, noting he hopes the federal government will get on board by bringing down interest rates – the main roadblock to purchasing a home in Ontario.

“We’re encouraging our friends in Ottawa to talk to the Bank of Canada to let off a little pressure,” Flack explained. “I think it’s time to get back to some normalcy and get people back into the affordability side of housing.”

In the coming weeks, the province will announce rewards for all municipalities that met, exceeded or achieved 80 per cent of their targets. If municipalities fail to meet their targets, that money will go back into the fund for disbursement to communities that met their goals.